And it has.

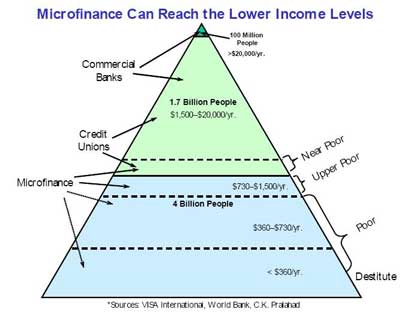

The microlending concept is simple: individuals, such as you, or I, can supply a small sum of money to poor farmers, urban workers, and other disadvantaged members of the economy. In the words of Jeffrey Sachs, an economist at Columbia University, "The key to ending extreme poverty is to enable the poorest of the poor to get their foot on the ladder of development. The ladder of development hovers overhead, and the poorest of the poor are stuck beneath it. They lack the minimum amount of capital necessary to get a foothold, and therefore need a boost up to the first rung. "

This idea has been a large factor in getting many residents of poor areas out of poverty. A study conducted by Professor David Gibbons in Malaysia, at the University of Science there, concluded that upwards of 50 % of the Grameen Bank’s members had escaped poverty within ten years. They also observed a significant elevation of women’s status in their own households.

With these notable successes in mind, it is time, perhaps, that we applied this idea which has caught on around the world, through online donation sites such as Kiva, in order to fix problems in the Western World. The problem in our society is not poverty, though the poverty rate is increasing. Poverty in developing countries means extreme, dirt level poverty, something we do not see often in America.

We ought to utilize the policy of microlending in order to combat this nation’s severe economic problems. The current administration’s attempts at fixing our crisis amounts to little more than lobbing money at more government projects, while the unemployment rate has stubbornly stayed at 9%.

What we need is a concerted effort amongst American businesses, perhaps in partnership with the American government but quite preferably autonomously, in order to facilitate loaning and the distribution of money to those who need it most: job creators. If companies were to set up small lending operations, such as microlending in poorer countries, and then allocate money to ideas, businesses, and people who will employ workers, then this can finally rid us of our economic chaos.

Though we cannot, and should not force businesses to commence such a program, I believe there would be much incentive to do so—even without tax breaks from the government on these job incubators. Many businesses have huge support systems. Car companies like Ford need small companies to design their fluid pressure sensors. Department stores in local marketplaces need regional connections to products that the residents of that specific area find valuable. Phone companies need programmers working out of their garages to create the next hit application. Such a support system is a win-win. If the large companies or wealthy individuals can create these support systems, as well as encourage the creation of additional companies, the whole economy benefits.

This program would be entirely grassroots, and business driven, which is why this idea can actually put Americans back to work, unlike a certain person’s stimulus bill.

Businesses create jobs, not the government. The only role for the government in this quest is to provide the smoothest role possible towards the creations of these lending entities. Hopefully this idea is something that both parties can agree on. While Republicans would like to get much more done, Democrats have obstinately dug in their hooves. We need action. We need a plan.

Taxing the rich, as the Democratic Party would propose, in order to cover the costs of more stimulus, is not as good an idea as they would let on. Many of these rich help create jobs. Additionally, they could help provide the capital for this new lending system. If the rich are willing to spend their money in this system rather than sit on top of it, as many companies are inclined to do in present circumstances, than tax away. But the upper middle class and some rich could provide the capital for this microlending system. The average loan for microlending in Bangladesh is 100 dollars. This is hardly enough to start a small business. Though in order to start creating businesses, a future businessman might not need too much money, he doubtless needs more than a Benjamin.

Perhaps why the concept of microlending can be so effective—and appealing—is that it is built to succeed without interference from large, powerful, national banks. Grameen Bank was a small loaning entity created as a research project. Many microlending services online act like charities. While the greed of bankers and asset traders, who sold off toxic loans from bank to bank, person to person, until loans (which were by now immensely profitable to the banks) were being given out to people who had no authority to even think about getting a loan, microlending sends a smaller amount of capital to a person with a firm belief in their own ideas and a drive to contribute for their families. In a struggling economy, we need such a mindset to help us haul through.

Muhammad Yunus himself recognized the value that his system could add to entrepreneurship. By encouraging people to be entrepreneurs, the poor could climb out of poverty. With special assistance, many enterprising people in America can get the small spark needed to form their own profitable businesses.

With so many problems of our own, it’s time we learned our own lessons. It is time to put America back to work. By stimulating our people to create, innovate, and succeed, we can shed ourselves of economic bondage and create a new entrepreneurial force in our beautiful country.

I selected this post to be featured on Economics Blogs. Please visit the site and vote for my blog!

No comments:

Post a Comment