Debt and deficit. People often confuse the two. Republican pundits attack Democratic policies on both.

A deficit occurs when all government incomes, called receipts, are less than the amount of government expenditures, called outlays. Revenues come from income and other forms of taxes. Expenditures result from a variety of purchases and entitlements. Since a deficit involves only a year's receipts and outlays, it applies to just one year. If the government took in $14 trillion and spent $15 trillion, the deficit would be $1 trillion.

When the government runs a deficit for a certain year, they need to borrow money in order to pay their bills. To do so, the Federal Reserve can print some or all of the shortfall, but this typically leads to inflation. How much inflation occurs depends on the amount printed. If everyone has more money, and there are the same number of products, then those products will become more expensive.

Usually, instead of printing money, the government operates in credit markets, issuing bonds, like private companies can. A bond is a form of a loan. when the US Treasury issues its bonds, it means it is promising to pay that money, which it needs now, in the future. When governments issue bonds, investors buy them up, selling them on secondary markets.

Debt, on the other hand, is basically accumulated deficits. If the government has to keep issuing bonds, borrowing money each year to pay its outlays, then the debt will continue to grow.

Debt typically grows each year. With each successive deficit, the debt, or at least the gross debt, will continue to grow. A misconception is that if the government takes in more than it spends, that its receipts are greater than its outlays, that there is no debt. This just means that the government has managed to run a surplus, but all debt that was accumulated previous years is still there.

It is accepted by most economists that some debt, sometimes, is a good thing for the nation and the economy. When in a recession, tax revenue falls because of the lack of business and personal growth. If tax rates are slashed, the revenues will fall even more. The government also spends more on its social programs such as unemployment insurance/benefits, so the government should run a deficit in order to pay for all that. Conservatives argue that deficits in bad times need to be offset by surpluses in good times. However, this does not need to be the case, when we consider debt in relation to our nations economic productivity, the GDP.

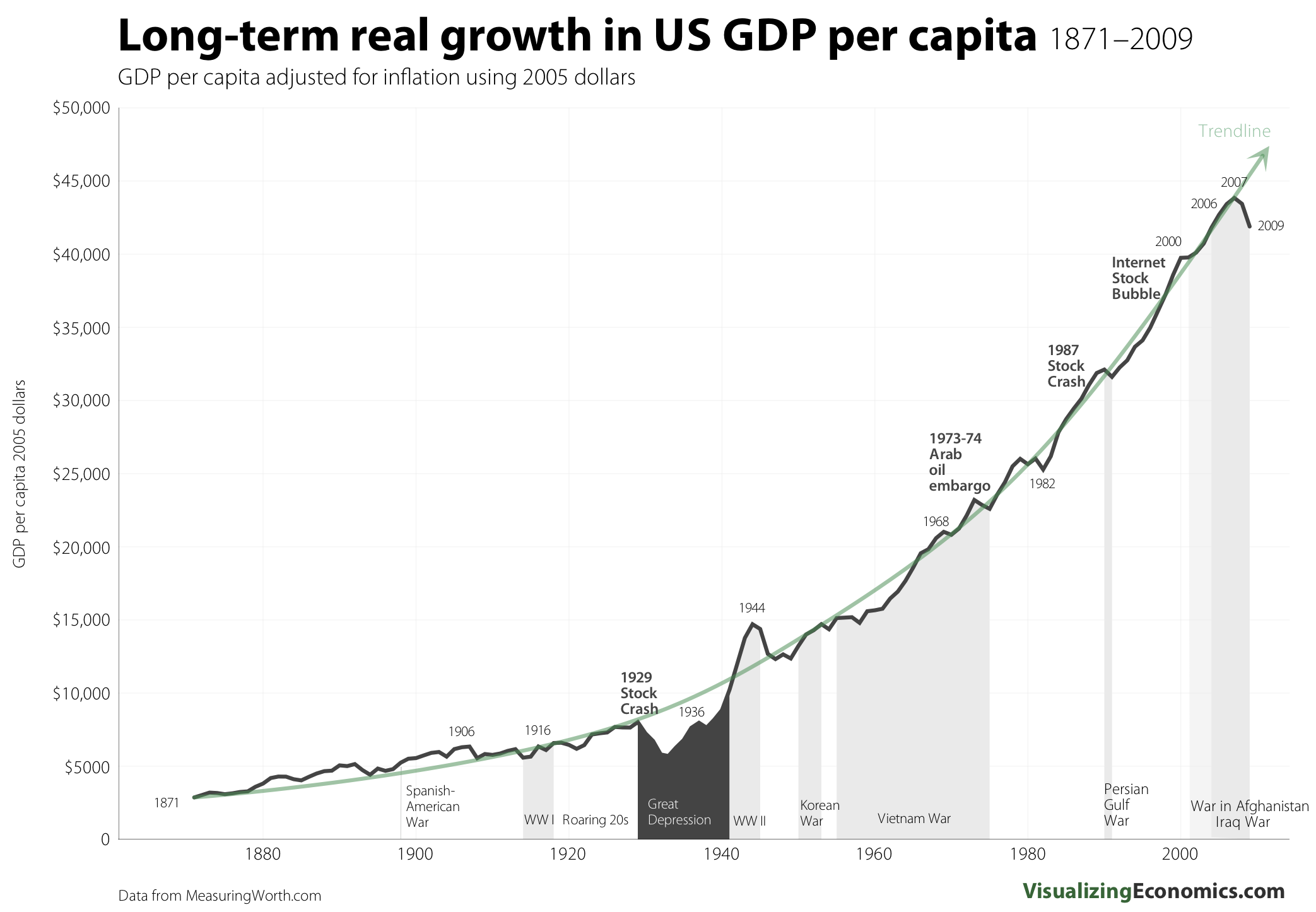

If the debt remains at a steady percentage of our GDP, the government can sustain that level of debt, even if they run deficits forever. Consider the following: if the government has debt of 30% of its GDP at the start of a year, and it ran a balanced budget, even though the gross debt stayed the same, the percent with respect to GDP will go down. The GDP almost always goes up.

The more our GDP grows, the more debt we can afford to take on. GDP is basically an equivalent of the nation's tax base. The more growth in the country, the more profits and salaries will rise, and the more tax revenue for the government.

There are negatives to government debt. When the government has to continually issue bonds, these bonds compete with private ones on the investor's market, pushing up interest rates. The more money the government takes from this market, the less money there is for the private sector.

Debt does have many positives though. Families, for example, go into debt and borrow money in order to buy a house or pay for college. The accumulated deficit of paying for one of these lasts for many years, but people still manage to pay it off. Debt makes the benefits of owning a house and higher education reachable for more people. Companies operate the same way, obtaining loans in order to expand, hoping for more profit later on. In the same way, government can go into manageable debt in order to pay for items that its citizens deem important.

No comments:

Post a Comment