Gross Domestic Product, or GDP, is used by many economists as a measure of the

overall strength of the economy. It its simplest form, GDP is calculated by taking household consumption and adding to it business investment, government spending and net exports. Below is a specific breakdown of each part of GDP for the United States in the second quarter of 2012.

One thing that is clear looking at this graph is how much household consumption contributes to our GDP. Housing and Utilities purchases alone ($2.0 trillion) exceed all Federal spending, which amounts to a little over $1.2 trillion.

Business investment contributes significantly to our GDP as well. The takeaway from this is that if we really want to boost our economy, finding ways to promote consumers to spend more money is the way to go. Here is a breakdown, by sector of the economy, of our GDP. This one references the GDP of 2009.

The percentages change from year to year, but generally we can see what parts of the economy are most important. Here's how the US fits into the larger world picture:

As we can see, the United States is a large portion of the world economy. It is the

largest portion, in fact. This means that the United States occupies a very important role as a producer and consumer of world goods. What affects the United States affects the whole world. We have seen this with the current financial situation. When the United States was drawn into a deep recession, so to was most of the world. In this country, we need to be mindful that our fiscal policies have a very wide ranging impact. The same can be said for other countries in emerging markets. When a single country occupies such a large slice of the world economy, their actions have huge consequences.

Here's a breakdown by state of our country's GDP:

The same lessons can be learned from this graph. California, as a large slice of the pie in America, affects many citizens all around the country because of their decisions. Indeed, they also occupy a large portion of the world economy. Silicon Valley, the entertainment industry, and agriculture are all huge parts of the world economy. Small decisions in Los Angeles or San Jose or even Salinas can have impacts on a large stage.

Our Ideas:

With all this in mind, we can figure out efficient ways to boost our domestic production. Increasing consumer spending and business investment is of paramount importance. By keeping interest rates down in a bad economy, more money can be freed up for consumers and businesses, so that they can spend it in the economy.

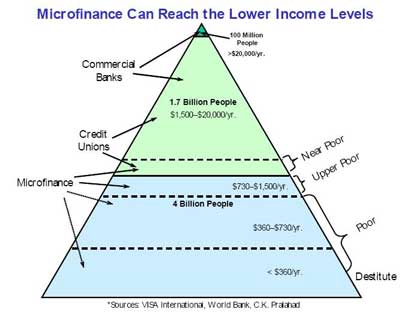

More needs to be done however. We advocate applying principles of

microlending to local communities in order to elevate people into economic success and sustainability. We have outlined such a proposal in a

previous post. While this is not a sole solution, it could go a long way to providing funds for consumers and small businesses.

In hard times, we also need to empower these same small businesses by lowering their tax rates. Small and medium sized businesses drive both business investment and household spending, so increases there will make a significant difference.

Additionally, much has been made of the United States' trade deficit. In the

topmost graphic, you will see a negative number for net exports. In the graphic below, you will see the net exports as an overall percentage of our GDP.

This is not necessarily a bad thing. Even though our trade deficit is large, it is only a small percentage of the total economy. Even if the gap got bigger, it would not necessarily mean that our economy would be worse off. If we go by the economic principle that trade increases wealth, a country with a trade deficit, if efficient, will make up that loss in some other area of the GDP.

We do this by

specializing. Importing items allows us to specialize in producing goods that we are especially good at making. We don't have to be a large exporter to be a powerful economy. If we have strong consumer spending and business investment numbers, as well as a certain amount of government spending, our economy will still be very strong for the future. This country needs to work on exporting goods, but we need not worry to much about this trade deficit, as long as it stays within a small percentage of our GDP, because we can always specialize and produce something different, capitalizing off trade.